Immediate Annuity

An immediate annuity is purchased with one single premium or a lump sum of money. Its purpose is to provide you with a lifetime stream of income. There are even options that allow you to extend that stream to the lifetime of your spouse if you pass away. A short and simple way to describe immediate annuities is “money for life”. There are a few things that can affect the income stream that you receive. Any income is calculated based on the amount invested, the payout rate, and your life expectancy. The higher the amount invested in the contract the more money you will receive. It's almost a mirror image of life insurance except in the reverse. Life insurance requires you to pay up premiums for a lump sum benefit when you pass away. An immediate annuity requires you to produce the lump sum up front in exchange for the payments for life. One of the major benefits that come with an immediate annuity is the tax-deferred status. You will pay taxes on the income as it comes in likely at a lower rate than you would if it was all pulled out at once. The payout rate is often the most important part of an immediate annuity contract. It determines the amount of yearly income you will receive from the annuity. A higher payout rate will result in a larger chance of you outliving the amount in the annuity and turning a positive investment. The best immediate annuities offer great payout rates and low fees that allow a retiree to cover basic living costs for life. Immediate annuities offer great protection from volatility risk that occurs from stock or other risky investments. As the stock market moves up and down the constant guaranteed stream of income from a guaranteed annuity can give retirees peace of mind. The certainty of an immediate annuity can provide comfort for those worried about running out of money during their retirement.

An immediate annuity is purchased with a lump sum of money. In return, the insurance company provides a guaranteed series of payouts over a specified period of time, or for the rest of your (or even your spouse’s) life — no matter how long you live. The amount of income you receive depends on a number of factors:

- How much money you use to buy the contract

- The interest rate environment at the time you purchase the contract

- The payout option you select (typically at the time the contract is issued)

- Your life expectancy — based on current age and gender

- When your first payment begins (within one year of issue date)

What are the advantages of an immediate annuity?

Hence the name, immediate annuities start paying out income immediately. Individuals in or approaching retirement may benefit from the predictable stream of income immediate annuities can provide. Contract holders can prevent outliving retirement income by purchasing an immediate annuity with a lifetime payment option. An immediate annuity allows a policyholder to lock in a predictable income stream that is unaffected by fluctuations in the stock market.

What are the disadvantages of an immediate annuity?

Over time, inflation can erode the value of income received from fixed return investments. Immediate annuities are no exception and may also fall victim to the damaging effects of inflation. For optimal portfolio allocation, immediate annuities can be paired with other investments that offer a hedge to inflation.

If the contract owner chooses a lifetime only payment option, the insurance company is contractually obligated to pay income for the rest of the contract owner’s life. However, if the contract owner dies shortly after buying a lifetime only immediate annuity, the insurance company keeps the remaining value of the annuity contract.

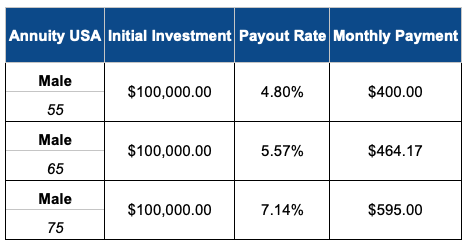

Immediate Annuity Rates

Next Steps:

If you think an immediate annuity may be right for you, click below to receive a no-obligation annuity quote. Our AnnuityUSA team members are standing by to help you find the perfect annuity to fit your goals!

Do you currently own an annuity?

Get instant access to our complimentary “7 Annuity Basics” report!