Is an Annuity Right for Me?

In order to unpack all the intricacies that come with deciding how an annuity would impact your retirement, let’s define an annuity. An annuity is an insurance product that you pay into in order to receive cash payments in the future. There are hundreds if not thousands of different ways that annuities can be structured. They are very popular among retirees due to their stability compared to other investments, like equities. The initial investment in an annuity occurs either as a lump sum up front or series of payments determined by the insurance company and the purchaser. After the payments have ceased there is a surrender period where the investor is not permitted to withdraw or touch the money. Afterwards, payments will be distributed monthly, quarterly, biannually, or annually. The frequency of the payments is typically decided upon when purchasing the annuity. The size of the payments will depend on the size of the initial investment along with age and length of the payout period.

Types of Annuities

There are two major kinds of annuities, and within those two types of annuities, there are two ways to invest the funds collected within the annuity. The first is traditionally known as a Deferred annuity and is one of the most popular types of annuities purchased by people that are not nearing retirement. The money will be invested for a specific period of time in payments defined by the insurance firm and the investor. This gives the money ample time to accumulate and grow through the various investment methods selected. After the surrender period, the money begins to pay out for a specified period or until one passes away. The second type of annuity is an immediate annuity.

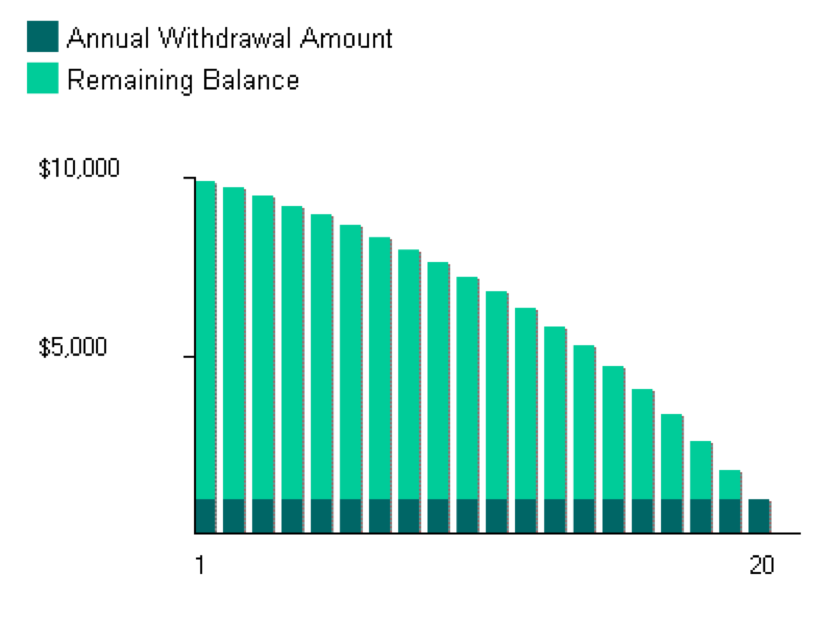

Figure 1: Immediate Annuity Model

An immediate annuity requires a lump sum investment that allows the payouts to begin shortly after the investments. This kind of annuity has a completely different trajectory because the investment is not given time to grow. This method is popular for those in retirement or approaching retirement that needs an immediate stream of cash to add to their retirement plan. The figure above gives a visual representation of the structure the annuity takes when paid with a lump sum and withdrawn immediately. Although investors can choose between immediate or deferred payments, every annuity needs a form of investment that allows it to grow. The two major investment types are fixed and variable annuities. Fixed annuities almost take the form of a Certificate of Deposit (CD). They pay fixed rates of interest throughout the life of the annuity, and these rates tend to be higher than the rates offered by banks for CDs. This can be applied to deferred or immediate annuities. For deferred annuities, the interest rate will accumulate as the money grows of the surrender and investment period. Immediate annuities will make payouts as usual after the lump sum and the money will decrease based on the withdrawal amount and the interest rate. Fixed annuities remain a popular option for those in retirement. Their steady rate of interest provides a predictable and constant stream of income during the payout period that will not be affected by economic or market conditions.

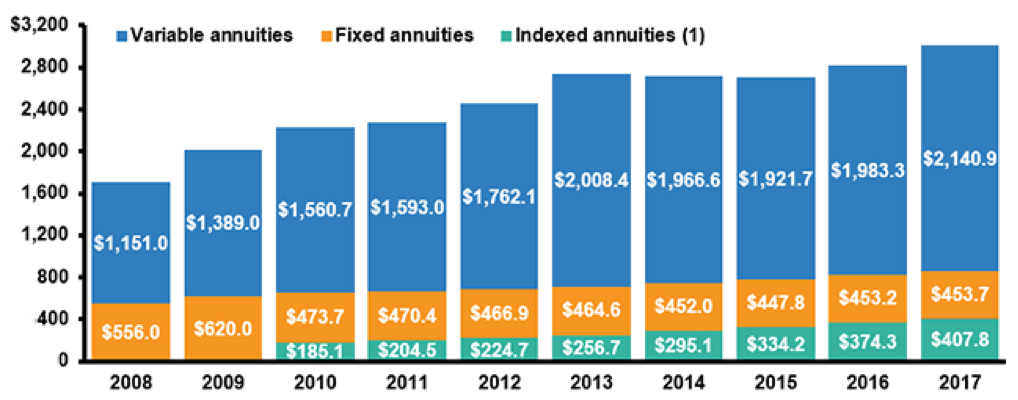

Variable annuities allow you to choose from investment options and pay out income based upon the performance of those investments. While these have downside risk unlike the fixed annuities, they give investors the unique opportunity to grow as the market grows. With the roaring bullish market of the last 10 years, deferred annuity assets have been geared more and more into variable annuities (Figure 2). The time in the market gives the annuity a better chance for capital growth and the opportunity to bounce back from any losses. A major issue with fixed annuities is that they cannot provide a safe haven from inflation. Variable annuities provide a way to outpace inflation through market growth making it an increasingly sought after investment option.

How can this help my portfolio?

Here at Annuity USA, it is our firm belief that there must be a holistic approach to retirement planning. One of the major areas glossed over or missed by many investors is the current and future tax environment. One of the biggest advantages of an annuity is that the invested money is allowed to grow tax-deferred. Although the money you invest is not tax-free the growth will be protected from taxation until the withdrawal period. Once withdrawals begin they are taxed on a last in first out basis. They fall under ordinary income; however, once the value of the annuity falls under the amount initially invested the taxation ceases. Since the investor already paid taxes on the initial amount they are only taxed for the growth amount. Most retirees find that they save thousands of tax dollars with annuities because they fall under a lower tax bracket in retirement than they were in before retirement. Another major advantage that comes with purchasing an annuity is there are no Required Minimum Distributions and no contribution limits. They are different from IRAs and 401-k accounts because there is no limit to the money one can invest and no deadline on when that money must be withdrawn. These freedoms give the investor space to make the decisions that are best for their individual situation.

Who would benefit from an Annuity?

One of the biggest concerns of anyone who thinks about retirement is the thought of running out of money. Annuities give the retirees a stream of income that can be free of downside (Fixed) or can have the opportunity to grow with the market (Variable). One unique option Annuity USA has offered clients who qualify is an Indexed Annuity. These annuities are a hybrid form of a fixed and variable annuity and in some ways offer the best of both worlds. Indexed annuities are tax-deferred protected from market loss but capitalize on market gains. There are many different ways they are structured, but most have a cap rate that locks in market gains on anniversary dates. However, there is no downside risk in the portfolio and there is often a minimum rate of return. Many different kinds of investors can benefit from an annuity; however, an annuity works best for people who have maxed out 401-k and IRA contributions and have extra savings. Investors that are in a very high tax bracket can also be offered an opportunity to benefit from the tax-deferred growth. It is important to remember that each individual has a different situation and will require different strategies to maximize their retirement dollars. Annuities are a great and increasingly popular investment vehicle. Depending on your needs they offer different ways to provide growth or safety.

Sources:

https://money.cnn.com/retirement/guide/annuities_equityindexed.moneymag/index4.htm?iid=EL

https://www.fool.com/retirement/2017/01/09/what-are-the-tax-benefits-of-annuities.aspx

https://smartasset.com/retirement/pros-and-cons-of-annuities

https://www.iii.org/graph-archive/96073

http://www.moneychimp.com/calculator/annuity_calculator.htm