Can a Fixed Indexed Annuity Replace your Fixed Income Portfolio

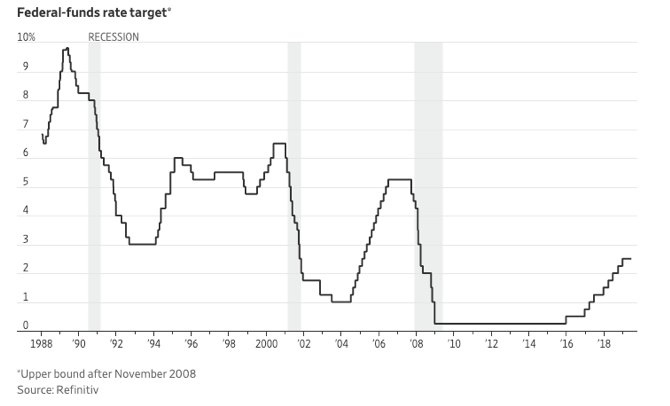

In times of market hardship it’s common for investors to flock to bond yields in order to safeguard their money. But is today’s bond market really the most efficient place to avoid market losses? I believe that current bond yields actually are not the most efficient way to protect your portfolio from market losses. It’s important to understand the different drivers of bond price and yield and how they are correlated in order to understand what the future may hold. Bond yields usually are directly correlated with the FED funds rate. When rates are cut bond yields tend to go lower. Rates are usually cut during times of economic downturn or recession aligns with the demand for bonds increasing as investors protect their portfolios. The increased demand along with the rate cuts drive the prices of the bonds up. Since prices and yields are inversely correlated the yields go down. The inverse is true when prices go up. Since the FED funds rate is also looked at as the risk free rate. Investors look to increase their alpha by going to higher returns in equities and other high yield investment products. Rates were dramatically driven up in 2018 causing bond prices to go down and yields to increase. However, the current trade war uncertainty has caused the FED to turn around and consider cutting rates again and investors have turned to fixed income for safety. The TNX is a ten year treasury yield tracker and illustrates how low bond yields currently are as they price in the possible rate cuts later this year. If rate cuts happen the yields will dive even lower making bonds inefficient decisive investments. The two charts below illustrate historical ten year treasury yields next to the historical rate cuts. They illustrate the correlation between the two that we expect to continue.

TNX Chart Historical Rate Cuts

Where can an FIA add value?

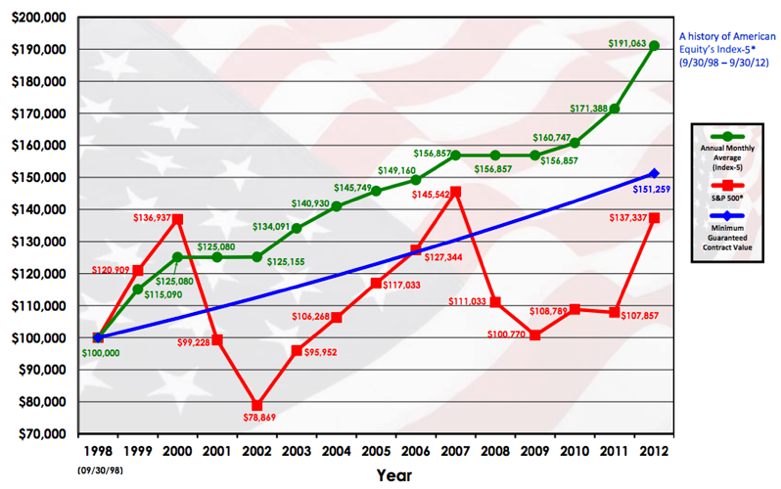

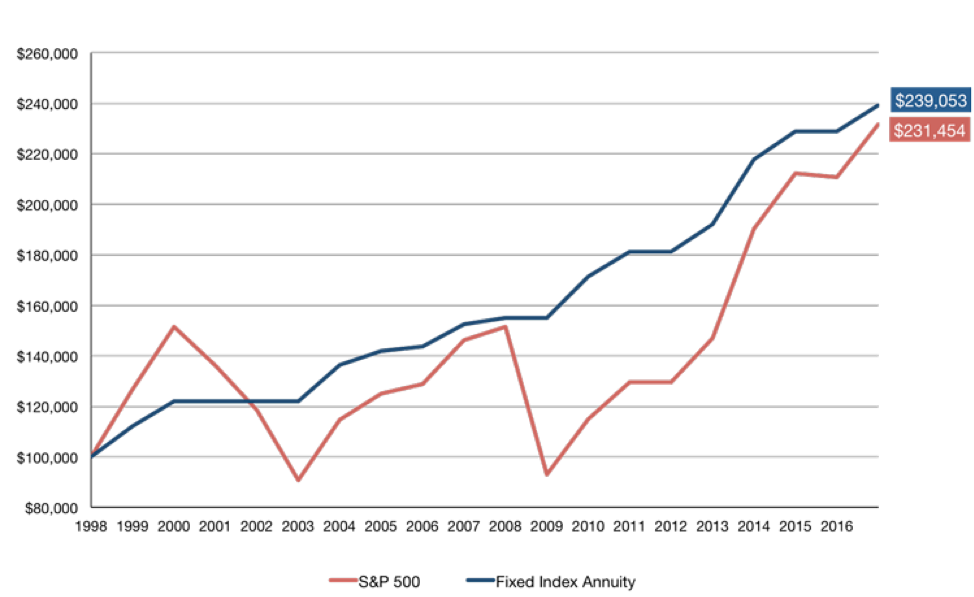

Fixed index annuities provide investors with the luxury of being protected from any market loses while participating in all the market upside. An annuity USA model illustrated that an FIA with a 50% participation rate actually beat the S&P 500 from 1998 – 2018. By avoiding market downside investors end up outpacing the most efficient form of the market over time. Treasury bonds have often been viewed as the best safe haven for investors during market downturns; however, we view the FIA as an emerging alternative. Ten year FIAs currently offer an average participation rate of 42% or a cap rate of 3.5-4% beating the TNX that is currently 2.1%. The guarantee of no downturn along with higher rates provide investors a unique opportunity in this economic environment to protect their capital from the market while earning a reasonable return. The best part about FIAs is they have options that offer a zero fees. This allows investors principal and interest to grow untouched with the maximum returns possible. An FIA offers investors the rare opportunity to have the best of both worlds. They are an efficient alternative to fixed income products especially in this uncertain environment. Do not let the FED determine the return on your portfolio and look into Fixed Indexed annuities as a viable investment opportunity.

Sources:

https://www.investopedia.com/terms/f/fixed-incomesecurity.asp

https://www.wsj.com/articles/if-the-fed-cuts-history-provides-guide-to-market-impact-11560426876

https://www.cnbc.com/2019/06/11/us-treasury-yields-tick-higher-as-investors-await-data-auctions.html

https://www.ohioinsureplan.com/annuities/annuity-charts/