How a good participation rate can beat the S&P 500

Beating the market is a goal many investors share and in recent years it has become almost unattainable. Here at Annuity USA, we created a model to test what an efficient method of beating the market would look like and we came across some surprising results. A Fixed-Indexed Annuity (FIA) with a good participation rate can beat and match market returns over time. So what is an FIA? An FIA is an insurance product that tracks a major equity index (S&P500, NASDAQ, MSCI, or Dow Jones) and provides an interest rate based on the returns of the underlying index. There are two different calculation methods used on FIAs. The first is a cap on the returns of a benchmark. This can be anywhere from 3-7% and is the maximum interest you can receive based on market returns. For example, if the market gains 10% and you had a cap rate of 5% you will receive your five percent; however, if the market only gains 3% you will only receive that 3% gain. The second way the interest is calculated is known as a participation or index rate. Participation rates give you a percentage of market gains. For example, if your participation rate is 50% and the market gains 10% you will be credited for 5%. It differs from the cap rate by making the gains unlimited. Both methods guarantee no loss if the market loses money or is negative providing a safe haven from volatility.

There are four ways that money can be credited to your annuity and each of them affects returns in different ways. Annual reset is the most common way interest is credited to annuity accounts. The benchmark gains are measured from anniversary date to anniversary date and the change in the market index is credited to the annuity. It’s a year over year measure of returns and is a very popular option. The Point to Point or term method is similar to the annual reset but usually requires a period of 5-7 years. It calculates the return during that entire period of time and credits it to the account. The third is referred to as the Annual High Water mark with look back. Usually based on an anniversary date, the highest return is used to determine the gain. The last is the monthly average method. It works just the way the name describes, the twelve monthly returns are averaged to decide at what rate the annuity will be credited.

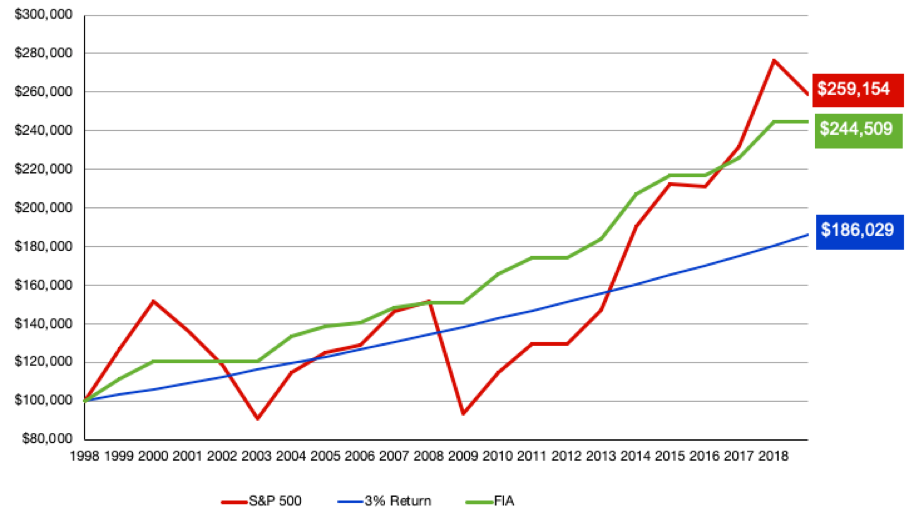

42% Participation Rate

The chart above illustrates the performance of an FIA with a 42% participation rate, credited by annual reset, compared to the S&P500 and a CD paying 3%. Over the last 20 years, the FIA increased with the market but did not have to experience the two recession losses (2000, 2008). An FIA has the opportunity to give you stock market like returns with the volatility of the bond market. Since annuity rates are correlated with ten-year treasuries, they increase as bond rates increase. This makes an FIA an attractive replacement for bond and money market investments that are struggling in the current environment.

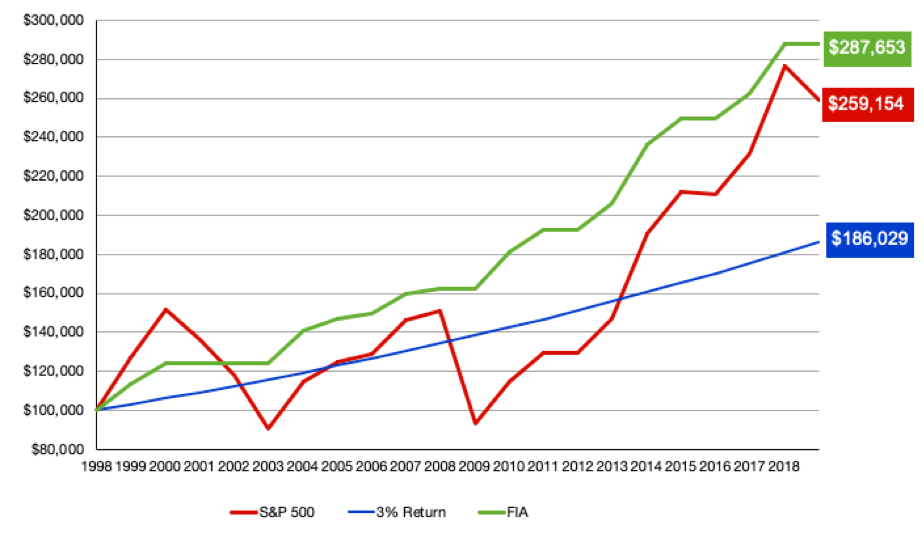

50% Participation rate

If the FIA participation rate is increased to 50%, the levels seen earlier this year in January, then over the last 20 years the FIA would have beaten the S&P500. The key to beating the market is not outperforming when market returns are good, it is outperforming when the markets are significantly down. Due to the zero downside risk of an FIA, investors avoid big losses while receiving a portion of the returns that the market offers. Unfortunately for retirees wall street was not built to provide retirement income due to its volatility. You never want to be in a situation that forces you to sell stocks at a loss in order to maintain your retirement lifestyle. Often investors turn to bonds and the money market to provide stable retirement income, but they end up sacrificing some growth potential as well. FIAs can provide the best of both worlds and have the upside potential to beat the market over time as well. As the market continues to become more and more volatile it’s important that you look to investments that protect your capital but do not sacrifice a reasonable rate of return.

Sources:

https://www.immediateannuities.com/fixed-index-annuities/

https://www.insure.com/life-insurance/annuities/eia-methods.html

https://www.annuityfyi.com/fixed-indexed-annuities/what-is-fixed-indexed/