Fixed Index Annuity

Now, more than ever, fixed index annuities (FIAs) can be a valuable addition to your retirement portfolio. Given the uncertain economic environment of the past decade, a good fixed index annuity can help protect your principal from negative market fluctuations while offering a guaranteed minimum interest rate with the opportunity to earn higher interested based on the upside performance of the stock market. A fixed index annuity offers a unique combination of benefits that can help you achieve your long- term goals. No other product offers the same tax deferral, indexed interest potential and optional benefits to protect your retirement assets and income from stock market losses.

With a good fixed index annuity, your principal and minimum interest are guaranteed against stock market losses. The best accounts are tied to the upside of an external stock market index like the S&P 500 or the Dow Jones Industrial average. Most fixed index annuities have a maximum amount you can earn in any one year. If the index is positive for the year, you have the ability to earn interest up to the cap or spread on your contract, but if the index is negative in any one year, your principal is protected. Any interest that is credited to your contract in one year can never be lost to market declines in other years. In the best contracts, each year your interest is “locked in.”

Cap

Some fixed index annuities set a maximum interest rate (or cap) that the contract can earn in a specified period. In an annual cap strategy, there is a declared annual maximum the contract can earn each year, which is referred to as the “cap.” For example, an index annuity with a 6 percent annual cap could potentially earn up to 6 percent each contract year. Let’s say the S&P 500® returned 7 percent in one contract year. Because the 7 percent met and exceeded the 6 percent cap, the contract holder would be credited 6 percent for the year. If the S&P 500® rose 4 percent the next year, the contract holder would earn 4 percent, because it is lower than the 6 percent cap.

Participation Rate

A participation rate determines what percentage of the index increase is used to calculate a contract’s credited interest. For example, if the insurance company sets the participation rate at 45 percent, your fixed index annuity will be credited with interest, based on 45 percent of any increase in the value of the stock market index. Let’s say the S&P 500® returned 10 percent in one contract year. The contract holder would be credited 45 percent of the 10 percent increase, which would equate to a 4.5 percent interest credit for the year. If the S&P 500® rose 20 percent the next year, the contract holder would earn 9 percent.

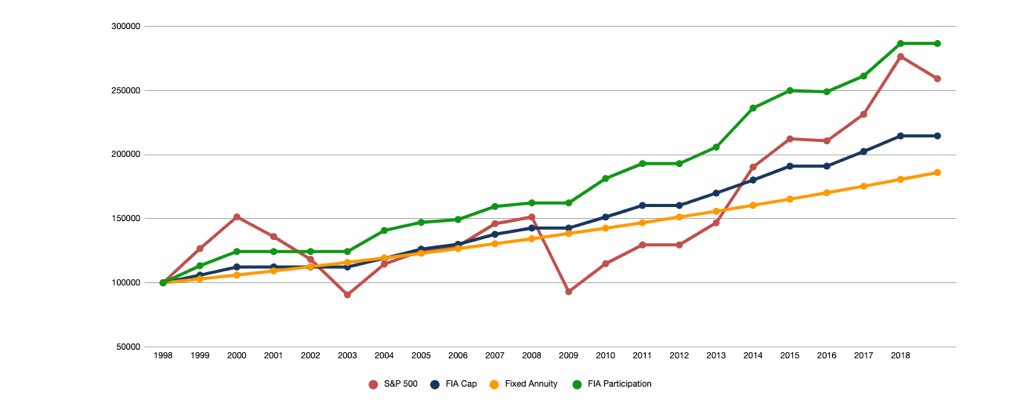

This chart shows the comparison over the last two decades of the FIA cap and the FIA participation.

The chart below shows two lines. The red line is the actual performance of the S&P 500 index going back to 1998. The blue line is the performance of an index annuity with 6 percent annual cap. Starting with $100,000 in 1998, after 14 years in the stock market, the account value grew to $146,829. The blue line, which is the fixed indexed annuity; saw no negatives over that time period and outperformed the market by 15.8 percent with an ending balance of $169,961.

As you follow the two lines you’ll notice when the red line goes up, so does the blue line. But when the red line goes down, the blue line stays flat. This is the power of a good fixed index annuity. When the stock market declines you may not make anything for that one year, but you are guaranteed not to lose any of your hard-earned money. As the red line starts to increase again, the blue line does as well. The blue line strategy allows you to go forward with your money, and never backward, up and never down. When discussing a retirement option that seems to provide the best of both worlds principal protection and reasonable returns, it is easy to classify the opportunity as “too good to be true.” While a fixed index annuity may be appropriate for the conservative- minded investor, there are two main “catches” to consider when looking at a fixed index annuity.

Catch #1TimeFixed indexed annuity contract holders invest their money for a certain period of time. This period can be as short as one year or as long as 40 years. The most popular accounts range from five to 14 years. During the initial time period, the best accounts allow withdrawals up to 10 percent of the account value each year without penalty. For example, if your account value was $500,000, you would be allowed to withdrawal $50,000 during that contract year without any penalty. Any withdrawals in excess of the 10 percent free withdrawal amount would be subject to a surrender charge. Fixed index annuities are completely liquid, minus the surrender charge. The only way to potentially lose money in a fixed indexed annuity is to cancel the policy during the initial surrender period. After the initial surrender period is up you are able to withdraw 100 percent of your money without penalty. |

Catch #2Maximum GainMost fixed index annuities have maximum amount of interest that can be credited to the contract each year. In most cases, this is calculated through a “cap” or “spread.” On each contract anniversary, a stock market index, like the S&P 500, is compared to the previous year’s index value. A positive percentage change in the index, up to a set cap, is credited as interest to the contract. If the S&P 500 Index change is negative , no interest is credited to the account for that year, but your contract value stays intact and does not decline. |

Next Steps:

If you think a fixed index annuity may be right for you, click below to receive a no-obligation annuity quote. Our AnnuityUSA team members are standing by to help you find the perfect annuity to fit your goals!

The chart shows the value of the S&P 500® and a hypothetical index annuity based on an initial value of $100,000 including the actual historical data of the S&P 500® for the 18-year period from 1/1/1998 to 12/31/2016 without dividends. The value of the hypothetical index annuity is computed based upon the annual participation crediting method, with a participation rate of 45% and assumes no surrenders or withdrawals during the period shown and no rider charges. The S&P 500® value does not reflect brokerage fees, sales charges, management fees, or other investment costs that may be incurred to invest in an S&P 500® mutual fund or to purchase S&P 500® options. An annual cap may cause the interest credited to be less than the annual percentage increase in the S&P 500®. The annual participation rate cap of 45% is based upon a typical cap for index annuity contracts issued by insurance companies under the current rate environment. Rates and caps are subject to change. The blue line also shows the value of the annuity if the S&P 500® return was zero or negative and reflects that annuity value will never be less than the premium paid, assuming no surrenders or withdrawals during the period shown. This chart shows how the value of a hypothetical index annuity does not decrease when the S&P 500® declines. When the S&P 500® increases, the annuity value increases, subject to a crediting method, by credited interest based upon the positive S&P 500® change. When the S&P 500® decreases, the annuity value remains the same – the value of the initial premium as well as prior credited interest are protected, as long as there are no early surrenders or excess withdrawals. As shown in years 2000 - 2002, 2008 and 2011, the fixed index annuity didn’t lose any value even though in those years the S&P 500® price index declined or was flat in value. A fixed index annuity is not any investment in the stock market and does not directly invest in any stock index. Past performance is not an indicator of future success.

1 Any amount withdrawn from your contract may be subject to ordinary income tax and, if taken prior to age 59 1/2, a 10% federal tax penalty.

2 Guarantees and protections offered by fixed and fixed indexed annuities are subject to the claims-paying ability of the issuing insurance company.

There have been no promises, guarantees or warranties suggesting that any strategy will result in a profit or will not result in a loss.

Do you currently own an annuity?

Get instant access to our complimentary “7 Annuity Basics” report!